Recently, various options for “television over the Internet” have become widespread. Globally, such projects can be divided into IPTV and OTT. Although, strictly speaking, OTT is a type of IPTV, they are usually considered as different services.

It is generally accepted that IPTV is a service within the operator’s network that provides “live” broadcast of channels, and OTT (short for Over The Top) is any video service (not only broadcast of channels, but also cinema, i.e. video on demand ), provided through “unmanaged” networks, including the Internet.

Many common operator platforms support both options within the same service, so it makes no sense to talk about a strict separation of IPTV and OTT.

Equipment for IPTV or OTT

TV manufacturers have not yet agreed on a unified standard for IPTV (OTT) services, and, moreover, its support in their products. Therefore, for now, users are limited in options for connecting to this service:

- For some Smart TVs, operators provide applications for connecting to the service. It is important that you cannot use a third-party solution here: the only one who can release such an application for this particular network is the operator providing the service (so you should look for the application immediately on the provider’s website).

- For any TV, both old and new, operators usually offer set-top boxes (similar to “terrestrial” or “cable” set-top boxes). Those. The ability to connect IPTV to this TV is determined by the presence of connectors on the TV for connecting a set-top box.

The cost of such devices, however, is somewhat more expensive than that of “terrestrial” set-top boxes. There are even “universal” devices that are supported in the networks of different operators (reconnection may require changing the device’s firmware, but at least not purchasing new hardware), and also serving as a home “media center” (for example, Dune HD).

- Many operators provide the ability to view channels on a computer. However, often the "computer" package is smaller; You can rarely find HD channels there (this is due to the restrictions of copyright holders, who in this way try to counteract piracy).

- Television is also actively penetrating mobile devices. But more on this later. Note that IPTV can broadcast HD, 3D and even 4K channels. But to view them you need a set-top box and TV that support the appropriate standards and resolutions.

TV on mobile devices

Some time ago, large telecom operators tried to establish full-fledged mobile television projects in Russia, introducing a type of “terrestrial” digital standard. However, due to lack of demand, which was a consequence of the low prevalence of receiving terminals, the projects gradually came to naught. But the idea of mobile television was revived with the combination of high-speed mobile Internet and IPTV.

The advantage of IPTV (OTT) compared to “terrestrial”, “cable” and “satellite” digital standards is that potentially a television signal can be received not only on specially produced devices, but also using any mobile device, incl. smartphone or tablet. The device does not need to have any “special” hardware module; you can limit yourself to only software “add-ons”.

This is what many telecom operators who have previously deployed IPTV (OTT) projects take advantage of. In fact, they don’t care which device the signal is transmitted to over the network, as long as the device has enough resources to quickly decode this signal. Such resources are now available even on cheap smartphones. At the same time, modern compression algorithms make it possible to generate a stream for watching television channels in decent quality, even through mobile devices.

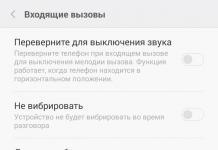

To work with encrypted content, telecom operators release applications for mobile devices. Moreover, often such applications allow you not only to watch channels, but to connect to a subscriber account to which the “main” device is also connected (for example, a home TV through a set-top box).

This combination allows you to manage a subscription to channels or a “home” set-top box, switch between devices while maintaining the viewing stop point, etc. (the latter service received the marketing name Multiscreen).

Paid cinemas, for example, Amediateka, offer content by subscription

Paid cinemas, for example, Amediateka, offer content by subscription By the way, recently many projects have appeared that are not associated with any “classic” telecom operator at all, but only offer video content for users with mobile devices and Smart TV. Among them, there are both paid “cinemas” (for example, Amediateka, amediateka.ru, which offers content by subscription), and free ones (for example, IVI, ivi.ru, where viewing is “paid” by you watching advertising videos. Both mentioned projects have mobile applications for different platforms, including Smart TV.

Photo: manufacturing companies

The pay TV market in the capital region is growing steadily. In this regard, Moscow is ahead of the rest of Russia and is a very attractive region for investment. The region is still lagging behind in this indicator. The positions of players in Moscow itself and the Moscow region are noticeably different.

Chapter 1. Moscow PTV market: more players, less players

As IKS-Consulting agency analyst Ekaterina Makarevich reported, the pay TV market in Moscow and the Moscow region is the most saturated in the country. Despite this, it continues to show fairly stable growth rates. “The penetration of pay TV services in Moscow, according to our data, at the end of 2014 increased by almost 5% and amounted to more than 120%,” commented IKS-Consulting analyst Ekaterina Makarevich. - The region is almost two times behind in this indicator; penetration here will be slightly more than 65%. However, the total penetration of Moscow and the region is approaching 100%.”

According to expert data, almost the entire market has grown due to the efforts of two operators: MTS and NTV+. “The first one showed an increase in the subscriber base of digital TV using GPON technology,” explained Ekaterina Makarevich. - The second adjusted the tariff policy and launched an extensive advertising campaign, which ensured an increase in the subscriber base by more than 200 thousand users across Russia. About 25% of this growth was provided by subscribers in Moscow and the region.”

Shares of pay TV players in the Moscow market by number of subscribers,

according to the analytical agency IKS-Consulting

There is one more and one less major player in the Moscow pay TV market.

A notable event in 2014 not only in the Moscow market, but also in the country as a whole, according to the analytical agency IKS-Consulting, was the entry of the MTS operator into the satellite TV market and the departure of the major player Raduga-TV from this market. “Most likely, the company will begin to actively promote satellite TV services in 2015, especially in an area where there is good growth potential and the opportunity to compete with Tricolor and NTV+,” said Ekaterina Makarevich.

Chapter 2. Package and individual offers of operators

The largest pay TV operator in the capital remains "". Other players currently have not come close to its positions: in Moscow it occupies 59% of the pay TV market, in general in Moscow and the region - 46%. “If we talk about the leading players in the Moscow market, then almost all of it is occupied by large federal players, the leader among which is, of course, Rostelecom,” said Ekaterina Makarevich. - The company promotes its TV under the “Online” brand. At the end of 2014, it was launched for Moscow subscribers. In the market of Moscow and the Moscow region as a whole, there is a slightly different arrangement of players, since the positions of satellite operators are traditionally strong in the region.”

Shares of players in the pay TV market in Moscow and the Moscow region by number of subscribers

according to the analytical agency IKS-Consulting

Rostelecom in the Moscow region actively developed the pay TV segment in 2014 and intends to continue expansion in 2015. As Inna Gubareva, head of the external communications department of Rostelecom, noted, there were several major achievements in 2014: the launch of the Interactive TV service in Moscow, an almost doubling of pay TV sales compared to 2013, and an increase in the number of users of package offers - also twice.

“Rostelecom in the Moscow region will promote Digital TV as one of its priority products, and also plans to increase the share of VoD, considering it as one of the tools for increasing the ARPU of the service,” commented Inna Gubareva.

It must be said that the VoD service is also actively developing. VoD (“video on demand”, English “video on demand”) is a system for individual delivery of television programs and films to a subscriber via a digital cable, satellite or terrestrial television network from a multimedia server. Thanks to it, subscribers can order films from the catalogue.

Another major player, AKADO Telecom, is focusing on package offers and expanding the range of pay TV channels.

Marketing Director of AKADO Telecom Andrey Boyarinov noted that during 2014 the company was actively working to expand digital television content. “Our network includes more than 30 new TV channels. Among them are rating representatives of the famous media holding Viacom International Media Networks and NTV-Plus,” Andrey Boyarinov explained. - Our company became the first cable operator in Russia to begin broadcasting a film channel in 3D format on its network - this is the NTV-PLUS 3D channel of the NTV-Plus television company. When making a decision to include a particular TV channel in our network, we take into account its ratings, the quality of video content, and the financial component. Due to the dynamic development of the TV market, the number of channels and the composition of television services does not remain unchanged.”

According to Andrey Boyarinov, in parallel with the inclusion of new channels, the company is actively working to increase the availability of pay television for all categories of users. It consists not only in expanding the line of subscriber equipment, but also in creating attractive offers for subscribers. In 2014, the company presented subscribers with triple play services (“Internet + digital TV + telephony”) with the ability to choose the most convenient tariff plan.

“We will continue to work on optimizing the quality of video content on the AKADO Telecom network, taking into account the needs of the viewing audience,” commented Andrey Boyarinov. - Also, in the interests of subscribers, we plan to launch a system of individual subscription to channels: practice shows that many customers want and are ready to purchase not the entire TV package, but only a few, high-quality and specifically interesting TV channels. In addition, we will try to provide everyone with the necessary subscriber equipment, offering them, for example, new Novabase HD devices. The distinctive features of these set-top boxes are the presence of an additional function - the ability to record television programs on USB media, as well as rewind and pause, compactness and energy efficiency."

As already mentioned, digital TV is a promising, constantly growing service. According to the IKS-Consulting agency, one of the main trends of 2014 was the increase in penetration of digital TV. If analogue television is growing by 3-5% per year on average, then digital television is growing by more than 15%.

Chapter 3. Russian TV market: 37.8 million households

The pay TV market in Russia as a whole, according to the TMT Consulting agency, continues to demonstrate stable growth. According to TMT Consulting estimates, the volume of the pay television market in Russia in 2014 grew by 6.1% and amounted to 57 billion rubles. The operator's subscriber base increased by 8.3% to 37.8 million households. Pay TV penetration was 68%.

Results of 2014 in the pay TV market according to the TMT Consulting agency.

Growth of the subscriber base and revenue compared to 2013

According to TMT Consulting estimates, there have been no changes in the composition of the largest players either in the all-Russian or Moscow markets. At the same time, experts noted the continued rapid growth in Russia of the satellite Orion Express, and in Moscow - of the MTS company. According to analysts, in Russia as a whole, MTS overcame the negative trend associated with the outflow of users of social packages in the process of transferring the company’s networks to digital technologies, and for the first time in three years showed an increase in its subscriber base. The annual growth rate of the largest operator, the Tricolor company, although decreased to 8% (compared to 14% a year earlier), still remains significant. The market leader in terms of revenue, Rostelecom, continues to increase the number of IPTV subscribers through the construction of PON networks. The growth of ER-Telecom has practically stopped due to the saturation of the markets of large cities where the operator operates.

Chapter 4. TV set-top boxes: players are waiting for domestic analogues

A sharply fallen ruble exchange rate can affect this pay TV market for one simple reason: equipment is purchased abroad and there are fears that it will become more expensive.

“Economic sanctions, of course, will affect the pay TV market, as well as many other sectors of the Russian economy,” said IKS-Consulting analyst Ekaterina Makarevich. - For example, equipment for watching digital TV, set-top boxes and routers are purchased from foreign partners, and exchange rate fluctuations adversely affect their cost. Here, operators who already had a stock of equipment in warehouses found themselves in an advantageous position. The rest will have to look for ways to optimize costs.” Thus, an increase in the cost of equipment will not necessarily affect subscribers - at least not immediately.

Market players explain that the issue of raising prices is still being discussed. Inna Gubareva, head of the external communications department of OJSC Rostelecom, said that negotiations are currently underway with suppliers on the price of equipment for 2015. There is no final decision yet.

All operators are ready to provide subscriber equipment, for example, in installments.

“In our work, we use equipment from such foreign manufacturers as Kaon (Korea), Novabase (Portugal), Humax (Korea), - said Marketing Director Andrey Boyarinov. - All payments under contracts that AKADO Telecom enters into with device suppliers are made in foreign currency. As a result of the fall in the ruble exchange rate, we are forced to purchase goods at new prices. The increase in value is a forced measure in response to the situation on the domestic foreign exchange market, despite attempts to keep prices at the same level. Unfortunately, this is a trend that has affected or will affect many companies working with foreign manufacturers and suppliers. New prices are set based on the results of financial and marketing calculations; the increase in the cost of equipment is economically justified and is lower than the dynamics of price growth on the foreign exchange market. To stimulate sales, we offer subscribers to purchase equipment in installments on terms favorable to them - both in terms of payment terms and in size. We also presented subscribers with affordable Novabase HD devices, the quality of which is not inferior to more expensive subscriber equipment. I think that import substitution of devices is possible in the future. Now there are no analogues of imported equipment on the Russian market. But we do not exclude the possibility that companies will appear in our country that will create high-quality products for the operator. And we will be ready to provide these companies with comprehensive support and development assistance.”

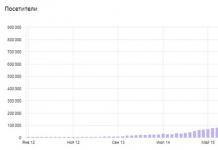

According to preliminary data from TMT Consulting, the number of pay TV subscribers in Russia in the first quarter of 2019 increased by 0.2% compared to the previous quarter and amounted to 44.3 million. Traditionally, the market in the first quarter showed negative dynamics - operator revenue decreased by 2.4% to 25.0 billion rubles. This was mainly due to the seasonal decline in mobile operators, as well as increased outflow in the cable TV segment.

TMT Consulting analysts note that the slowdown in subscriber base growth continues in the pay TV market: the number of users in 2018 increased by 3.2% against 3.8% in 2017 and reached 44.2 million. They attribute this to the fact that the possibilities for increasing the subscriber base are almost exhausted. Pay TV penetration already exceeds 77%, and users have

The pay TV market continues to see a slowdown in subscriber base growth: the number of users in 2018 increased by 3.3% against 3.8% in 2017 and reached 44.2 million. Growth opportunities are almost exhausted: penetration already exceeds 78%, and users There is an alternative in the form of digital terrestrial TV and Internet broadcasting of TV channels. However, multi-service operators still see potential

“The total increase in the subscriber base in the third quarter amounted to 203 thousand. Three quarters of the increase came from IPTV technology, another quarter from satellite television. The number of cable TV subscribers has decreased by 30 thousand. Market structures in terms of subscriber base and revenue vary greatly. IPTV technology still has the fewest subscribers connected, while the smallest

TMT Consulting notes that this year the growth of the subscriber base in the pay TV market continues to slow down: the growth in 2018 was 2.1% versus 3.6% in 2017. However, revenue dynamics remain stable (in 2017 it was 10.6%). The agency attributes this to the fact that some operators have raised the cost of subscription fees, and their clients began to consume

“Market structures in terms of subscriber base and revenue vary greatly: IPTV technology still has the fewest subscribers, while satellite television has the smallest share of total revenue. The differences are explained by the large variation in the cost of services: while the ARPU of an IPTV user in the 3rd quarter amounted to 307 rubles, in satellite TV

According to TMT Consulting, the number of pay TV subscribers in Russia in the 3rd quarter of 2018 increased by 0.6% to 43.8 million, service penetration exceeded 77%. Operators' revenue increased by 6.5% compared to the previous quarter and amounted to 24.2 billion rubles. The average bill per subscriber (ARPU) increased to 185 rubles. excluding VAT - this is 17 rubles more than a year earlier.

“The first subscriber outflow in the entire history of the company - 80 thousand subscribers in one quarter - occurred in the first quarter of 2018, and then the company attributed it to objective reasons - the transfer of broadcasting from MPEG-2 to MPEG-4 format. Despite the technological support, not all clients switched,” says Elena Krylova, project director at TMT Consulting.

“The share of Rostelecom in the revenue structure continues to grow - the operator already occupies over a third of the market, more than twice as large as the operator Tricolor, the largest operator in terms of subscriber base,” notes TMT Consulting. Thus, Rostelecom's share of revenue in the third quarter was 36%, Tricolor - 16%, ER-Telecom - 10%, MTS - 8%. “Market structures in terms of subscriber base and revenue vary greatly: IPTV technology is still connected

The table shows the channels that can be received from the Ostankino TV tower in Moscow and the Moscow region. The list is divided into two groups - digital DVB-T2 and terrestrial analogue. Operating frequencies, numbers, characteristics are indicated. All federal channels are broadcast free of charge. Coded or paid services are not yet provided. Digital program packages are distributed among multiplexes, each with 10 channels, 20 are already running as normal, and the third multiplex is being tested. First and Russia 1 come in high definition HD quality. Breaks in broadcasting are regulated by the prevention schedule. Search and configuration are possible in automatic or manual mode. Most apartment buildings have cable television, and in the general list you will only find the list provided by the operator. In this case, for reception, you will need an external or internal independent antenna.

| The first digital terrestrial TV multiplex | ||||||

| Channel logo | Name | Number | Frequency | Genre | Video format | Audio format |

|---|---|---|---|---|---|---|

| 30 | 546 MHz | Federal | MPEG4 | MPEG2 | ||

| 30 | 546 MHz | Federal | MPEG4 | MPEG2 | ||

| 30 | 546 MHz | Sport | MPEG4 | MPEG2 | ||

| 30 | 546 MHz | Federal | MPEG4 | MPEG2 | ||

| St. Petersburg - Channel 5 | 30 | 546 MHz | Federal | MPEG4 | MPEG2 | |

| 30 | 546 MHz | Federal | MPEG4 | MPEG2 | ||

| 30 | 546 MHz | News | MPEG4 | MPEG2 | ||

| 30 | 546 MHz | Children's | MPEG4 | MPEG2 | |

| 30 | 546 MHz | Public television of Russia | MPEG4 | MPEG2 | |

| 30 | 546 MHz | Federal | MPEG4 | MPEG2 | |

| 30 | 546 MHz | Radio | - | MPEG2 | ||

| 30 | 546 MHz | Radio | - | MPEG2 | ||

| 30 | 546 MHz | Radio | - | MPEG2 | ||

| Second digital terrestrial TV multiplex | ||||||

| 24 | 498 MHz | Federal | MPEG4 | MPEG2 | |

| 24 | 498 MHz | Religion | MPEG4 | MPEG2 | ||

| 24 | 498 MHz | Entertaining | MPEG4 | MPEG2 | |

| 24 | 498 MHz | Entertaining | MPEG4 | MPEG2 | ||

| TV3 | 24 | 498 MHz | Entertaining | MPEG4 | MPEG2 |

| 24 | 498 MHz | Entertaining | MPEG4 | MPEG2 | |

| 24 | 498 MHz | Military Patriotic Channel | MPEG4 | MPEG2 | |

| 24 | 498 MHz | CIS channel | MPEG4 | MPEG2 | ||

| 24 | 498 MHz | Movies | MPEG4 | MPEG2 | |

| Muz TV | 24 | 498 MHz | Music | MPEG4 | MPEG2 | |

| The third multiplex of digital terrestrial TV It has not yet been officially launched, so the list of channels is displayed on a separate page with a broadcast schedule |

||||||

In the analog range, the number of regular channels is smaller and they are planned to be switched off in accordance with the official government program for the development of digital television.

The information was obtained from open sources and is current as of the beginning of 2019. As the grid changes, the data will be updated.

Article 37. Erotic publications

×Law of the Russian Federation dated December 27, 1991 N 2124-1 (as amended on July 13, 2015)

"About the media"

Distribution of specialized radio and television programs of an erotic nature without signal coding is permitted only from 23:00 to 4:00 local time, unless otherwise established by the local administration.

For the purposes of this Law, a mass media specializing in messages and materials of an erotic nature means a periodical publication or program that generally and systematically exploits interest in sex.

Retail sales of media products specializing in messages and materials of an erotic nature are permitted only in sealed transparent packaging and in specially designated premises, the location of which is determined by the local administration.

During the first half of 2016, more and more Russian viewers are choosing Internet television (IPTV). Vedomosti writes about this with reference to a study by the TMT Consulting agency.

According to the information received, during the period from January to June of this year, the number of IPTV subscribers increased by 540 thousand, while satellite TV - by 220 thousand. Back in 2015, the situation in Russia was radically different: the number of Internet television subscribers increased by 420 thousand, and satellite ones by 650 thousand.

Also, according to the TelecomDaily agency, in the first half of this year the number of pay television subscribers in Russia amounted to 40.5 million: 6.2 million chose IPTV, 15.9 million - satellite TV, and 18.3 million - cable TV. As noted by company analyst Elena Krylova, while in the satellite and Internet television segments there was an increase in the audience, for cable TV operators it decreased slightly.

Shares of pay TV segments in the total volume of services based on the results of the first half of 2016

Shares of pay TV segments in the total volume of services based on the results of the first half of 2016 Almost 90% of connections in the first half of 2016 were carried out by the five largest Russian TV operators. Tricolor TV became the leader in the segment, increasing the number of its subscribers by 40 thousand to 11.91 million households. It is followed by Rostelecom, which attracted 230 thousand subscribers. Its audience reached 9.02 million. Orion Express closes the top three with its subscriber base, having increased by 38 thousand subscribers over the specified period, reaching 2.877 million. In fourth and fifth places are the operators MTS and Er-Telecom, the number of viewers of which is 2.765 million and 2.730 million, respectively.

1 of 2

As the general director of TelecomDaily news agency Denis Kuskov told the TASS agency, the volume of the pay TV market in the Russian Federation this year will increase by 7.5%, which will amount to 72 billion rubles, and last year it was much less - 67 billion rubles. He also noted that this year the figures increased to 8.3% and amounted to 35.2 billion rubles. Mr. Kuskov attributes this precisely to the growth of pay television subscribers. According to his assumptions, by the end of the year the pay TV subscriber base in Russia will reach 41.1-41.2 million subscribers.

Dynamics of growth of the pay TV subscriber base quarterly (in thousand subscribers)

Dynamics of growth of the pay TV subscriber base quarterly (in thousand subscribers) Also, according to Kuskov, the crisis does not affect the pay television market in any way, since the average bill remained within 155 rubles.

However, in a year or two, according to Denis Kuskov, such rates of increase in subscribers among pay television operators will not be observed. The reason for this may be the construction by wireline operators of their own networks in regional centers.